Amongst the factors which need and deserve to be duly taken into account when making decisions about individual pay, an in-depth and thorough knowledge of the relevant labour market rates definitely plays a crucially significant role. The approach most widely recognised, and thus most extensively used, to investigate labour market rates is known as “market pricing.”

Although

job evaluation and market pricing should not be considered as mutually

exclusive, especially in the past, these have been habitually perceived as

conflicting methodologies and used hence the one as a substitute for the other.

Market

pricing has traditionally caught companies CEOs interests in that enabling

businesses to better compete in the war for talent it well encapsulates the

spirit of competition (Armstrong, 2006). Having an appropriate and thorough knowledge

of market rates can in fact put a company in a position to design more attractive

and competitive reward packages, which at least in the first instance might

reveal to be rather effective to lure to the organization new talent from the

external environment. The same attractive appeal cannot be indeed deemed typical

of the job evaluation approach, which is rather widely considered as a boring

and definitely less vibrant reward management tool.

The

approach to salary determination dominating in the US in the 1990s, as

basically opposed to job evaluation, was actually market pricing. The explanation

of the reason for that could be basically condensed into the conviction that: “a

job is worth what the market says it is worth.” Job evaluation, which in

contrast is concerned with internal relativities, was hence deemed as a pointless

exercise by employers, who essentially preferred to exclusively focus their

attention on the external labour market rates. Yet, as desired by employers, market

pricing was actually also enabling these to ease the development and

introduction of pay systems based on a reduced number of salary bands and grades,

the so-called “broad-banded” pay systems (Armstrong, 2006).

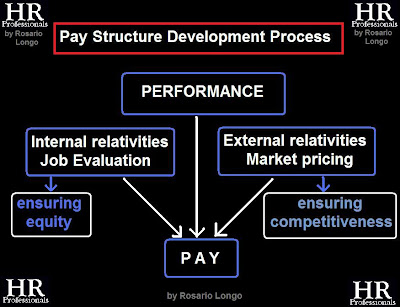

It

could be contended that job evaluation and market pricing are both basically intended

to enable employers to achieve the same unique objective, that is to say to

identify the most effective, consistent and appropriate way to determine the pay

level of their employees. To help organisation to achieve this objective,

nonetheless, the two methods follow two different paths:

- Job

evaluation, which is concerned with internal relativities and aims at assessing

the size and importance of the different jobs performed within an organisation,

essentially investigates the endogenous environment;

- Market

pricing, which aims at investigating and letting gain an employer knowledge of

the pay levels offered by the other employers operating in the same market for

the same type of jobs which are the object of the investigation is concerned

with the exploration of the exogenous environment.

Inasmuch

as job evaluation has attracted over time a rather widespread criticism for

being judgmental and, as such, not representing a scientific approach, market

pricing has not escaped the same type of criticism. The outcome of a market

pricing investigation in fact does not enable employers to scientifically

identify a single, unique pay rate for each investigated role. On the contrary,

even when taking into consideration a single type of job with reference to a

single location, it does produce a number of different pay rates (CIPD, 2010).

The

effectiveness and reliability of market pricing essentially sorely depends on

the way jobs are matched. Mismatching jobs can indeed produce undesirable

consequences: at best void of any meaning the exercise and at worst produce

counterproductive effects in that the individuals in charge of carrying out the

exercise might reach completely wrong conclusions, to the detriment of the

achievement of the business intended objectives. Reportedly, inappropriate job

matching is the major cause of inaccuracy, and even failure, in market data

collection for market-pricing-related reasons.

More recently, external comparisons based on “job capsules”, rather than on job titles have revealed to be more reliable and accurate. In order to better match internal with external jobs these are designed maintaining the main focus on job responsibilities and challenges.

Job

capsules can also reveal to be somewhat of effective to determine internal

relativities. Whether designed and developed with accuracy and whether the information

included for each capsule is wisely and craftily selected, these can be easily

understood both internally and externally, contributing to making it more straightforward

comparing the internal with the external roles.

As claimed

by Armstrong (2006), also market pricing can help organisations to investigate

and determine the internal relativities, even though the exercise would be in

this case driven by the external market. Whether the internal investigated jobs

are in fact accurately and appropriately matched with the external jobs, the

findings of market pricing may actually reveal useful in order to determine internal

relativities, too. In this instance, notwithstanding, mismatching the internal

and external roles would account for this technique revealing even more

unwieldy. Yet, employers deciding to have recourse to this type of approach

should be aware that by doing it they exclusively and totally rely on the indications

provided by the external environment, that is to say the external labour market.

As internal relativities should also be established according to the different

strategies pursued by an organisation, notwithstanding, it follows that it

could hardly and eventually only by chance happen that the jobs grades defined

by market pricing may actually appropriately reflect the organisation strategy.

This risk could be mitigated by using only data gathered within exactly the

same kind of organisations; nonetheless, it is very unlikely that the

one-size-fits-all approach in such matters may reveal appropriate and may

produce valuable effective results. Employers deciding to embrace this approach

should duly consider and be well-aware of this aspect.

The effectiveness of market pricing is clearly

strictly depending on the quantity, quality and reliability of the data

collected (Armstrong, 2006). External data can be gathered in a variety of ways:

participating in pay clubs, gaining access to specific surveys (safe in the

knowledge that the payment of a fee might be required to access reliable,

quality data), scrutinising the appointment section of newspapers and journals and

visiting the countless specialised websites.

The effectiveness of market pricing is clearly

strictly depending on the quantity, quality and reliability of the data

collected (Armstrong, 2006). External data can be gathered in a variety of ways:

participating in pay clubs, gaining access to specific surveys (safe in the

knowledge that the payment of a fee might be required to access reliable,

quality data), scrutinising the appointment section of newspapers and journals and

visiting the countless specialised websites.

More

recently, the most reliable source of data for the market pricing exercise has

revealed to be the “specific market rate pay data”, according to which data is gathered

by means of bespoke surveys conducted for well-pre-identified purposes and with

reference to well-specified areas. This type of surveys is expected to produce more

reliable and trustworthy data in comparison with that provided by wide-ranging surveys.

Once

the external investigation has been completed, an accurate internal activity,

the most important indeed, has to be carried out within the organisation. The

data collected needs to be interpreted and decisions need hence to be made for

each position in order to determine where, in relation to the market salary

band identified, the organisation intends to position its own salaries level.

It is clearly at this stage that the business reward strategy comes to play; decisions

have obviously to be made in fact according to this.

The

internal analysis has to be indeed carried out also taking extra care of the equal

pay regulations introduced locally by the different governments. Whether the

market at large should not pay attention to equal pay legislation, passively

accepting the externally collected data could easily expose employers to the

risk of breaching the local legislation.

As

discussed earlier, job evaluation and market pricing are by no means mutually

exclusive; they both aim at achieving the same objective, but following a

different route. Used together they can really enable companies to design and

develop strong and sound pay system structures.

Job evaluation

basically enables employers to: assess the importance of each job within their

organisations, prevent jobs duplications and gaps and ultimately implement a salary structure compliant with equal pay legislation.

Market pricing on the other hand aiming at thoroughly and earnestly investigating the relevant labour market (local, national or international) essentially enables businesses to more effectually attract and retain individuals. The information collected enables firms to identify the most suitable salary bands for each type of job and consequently to decide in which point in the band they intend to position themselves.

The

CIPD (2010), nonetheless, also acknowledges the existence of some “tensions” between

the two approaches. The results emerged from job evaluation could in fact reveal

to be in contrast with the findings of market pricing. The combination of the

two techniques, however, has the scope to help employer to determine the

importance of a role within an organisation and ensure that each job-holder

receives a level of pay which is appropriate and adequate to the current market

rates. The identification of any gaps is intended to eventually bridge the substantial

differences emerged and enable employers to attract and retain employees. It is

not ultimately a matter of tensions, but rather a matter of somewhat of a

synergic approach generated by the combination of the two methodologies, by

means of which the contribution of the one tool supports further the

contribution made by the other.

As claimed

by Armstrong (2006), market pricing is a very valuable tool enabling businesses

to “reconcile the different messages provided by job evaluation and market rate

surveys.” Whether the market rates for some roles should reveal to be higher

than those identified as a result of the internal exercise, employers should

opt to include a market supplement to those levels of pay in order to the

company value proposition sound more appealing and dramatically increase the chances

to attract and retain individuals.

In

order to prevent and eventually overcome the risks habitually associated with

equal pay claims, these additional salary quotes, that is to say the market

supplements, should be supportable, objectively justified and corroborated by

adequate evidence proving that these are actually offered by reason of the competitive

rates offered by competitors in the relevant market(s) (Armstrong, 2006).

By reason

of the employers need to be complaint with equal pay legislation, during the

last decade the number of organizations having recourse to job evaluation in

the UK has steadily increased. Findings of several studies reveal that not only

the number of organizations using this methodology has indeed constantly grown,

but also that this number is destined to grow further in the incoming years. In

particular, research has revealed that job evaluation is also increasingly used

by public sector employers, to wit: local authorities and the NHS. Reportedly

on the other hand once organisations have adopted job evaluation just a very few

of these decide to abandon the approach.

For an extended version of this article and much, much more click here

Related article(s) in this site: